How to Find Your PIN Number for Your Debit Card

Misplacing or forgetting your debit card PIN can be a hassle. A misremembered or lost PIN impedes your transactions and hinders seamless banking. This article will walk you through the steps on how to find the PIN number for your debit card and safely store it with a multi-functional 7ID App.

Table of contents

- What is a PIN Number?

- Where and How You Receive Your PIN Initially?

- The Importance of Memorizing Your PIN

- How to Find Your Forgotten PIN

- Keeping your PIN secure with 7ID app: guideline

- Reasons for changing your PIN

- Extra tips for safeguarding your PIN

What is a PIN Number?

A PIN is short for Personal Identification Number. Essentially, it acts as your own password, typically consisting of numeric digits. Although it's most commonly associated with financial institutions for accessing and authorizing bank accounts, its utility extends to many more applications.

Because of their versatility, PINs are used in various digital identities. They serve as an essential security element in encrypting devices, providing access to mobile phones, and even functioning in home security systems. As such, the PIN embodies a universal digital key that strengthens secure access across multiple platforms.

Where and How You Receive Your PIN Initially?

The typical process of getting a debit card begins when an individual opens a bank account or requests a debit card from their existing bank. The banking institution will typically mail the client their newly minted debit card upon approval.

The Personal Identification Number (PIN) is usually sent separately in a sealed envelope. Sometimes, the bank allows the customer to set up their unique PIN through an online banking portal or during a visit to a local branch. This separate PIN provision adds an extra layer of security to prevent unauthorized use if the debit card is intercepted in transit. You will receive your PIN either by mail, over the Internet, or directly from your bank.

The Importance of Memorizing Your PIN

Remembering your PIN is critical to maintaining both convenience and security. This unique number acts as your digital signature, facilitating efficient transactions while protecting against unauthorized access to your accounts.

By memorizing your PIN, you eliminate the risk of it being discovered by malicious parties, safeguarding your financial assets. It also ensures smooth, trouble-free transactions, whether at ATMs or point-of-sale terminals. Remembering your PIN enhances security and makes digital finance easier to use.

Read on to learn how to remember all your PINs using the 7ID App efficiently.

How to Find Your Forgotten PIN

Here are the steps to follow if you forget your debit card PIN: (*) If available, use your bank's website or mobile app to reset your debit card PIN. This is often the fastest method. (*) If that's not possible, visit your bank branch in person with a valid ID, and they may be able to reset your PIN right away. (*) If visiting a branch isn't possible, call your bank. They may need to mail you a new PIN for security reasons. (*) Some banks allow you to change your PIN through their website or app's help center, usually under Security or Personal Settings. (*) Alternatively, a new PIN can typically be set up through the bank's mobile app or online banking system. (*) A bank customer service representative may also be able to get your PIN over the phone. (*) If you can't access your PIN online, you may need to contact your bank directly. (*) It's important to correct a forgotten PIN immediately, as it could affect your ability to make purchases or ATM withdrawals.

Remember, as a safety precaution, you should never carry your written PIN with you on your debit card in case it is misplaced or stolen. Instead, you can write it down and keep it safe at home.

How do you find your PIN number on your phone?

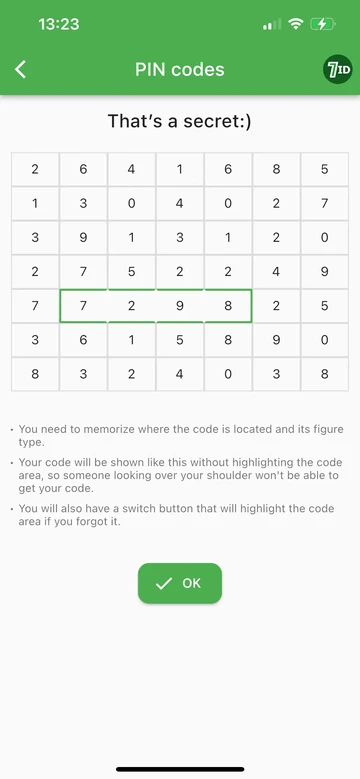

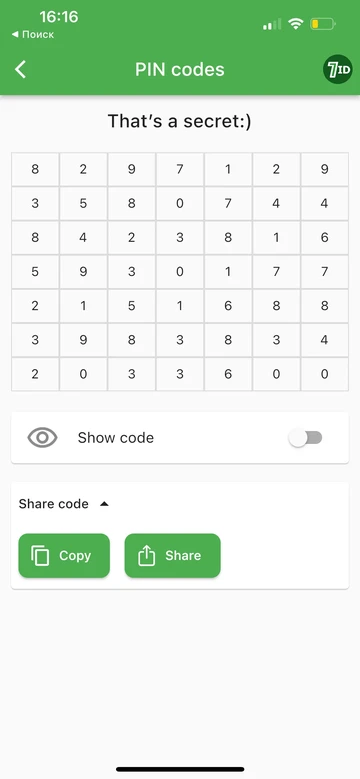

In some cases, you can find your debit card PIN on your phone by using your bank's mobile app, if available, to reset it. If you are using a special 7ID PIN Storage App, you can find any of your PINs in this digital safe in no time: (*) The app will display the combination. Surely, you are the only one who can remember the correct location of the code. (*) If you forget the location, there's a 'Show Code' function, but make sure there's no one around to prevent unauthorized access.

How do I unblock my debit card after entering the wrong PIN 3 times?

If you enter your debit card PIN incorrectly three times, your card will be temporarily blocked. To unblock it, you can try the following options: (*) Use an ATM: Insert your card, enter the correct PIN (available in the app), and follow the “PIN Services” and then “PIN Unlock” sequence to unblock the PIN. (*) Via the bank website or app: Try to reset your PIN. If unavailable, your bank may require an in-person visit, a phone call, or a new PIN mailed to you. Proof of ID is usually required for an in-person PIN reset. (*) By phone: Call your bank's customer service center. (*) By formal request: If none of the above options work, consider writing an official letter to your bank requesting to unblock your ATM card.

Keeping your PIN secure with 7ID app: guideline

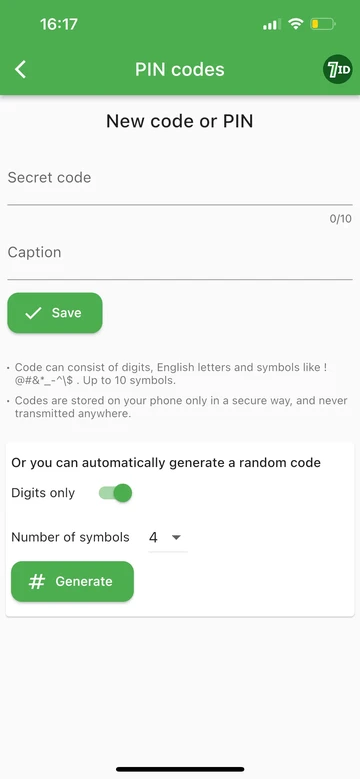

Looking for a simple tool to manage and secure your PINs? Look no further. Follow the below-listed recommendations and keep your PIN safe with the 7ID app: (*) Start by downloading and installing the 7ID App—your ultimate digital locker designed to safeguard all important PINs. (*) Use the Code hiding and memorization technology. This 7ID feature buffers your actual code in a pool of numbers. Remembering the exact position of your code in this mix of numbers secures your PIN from being cracked, even if someone has access to your combination. (*) Use Code naming to label and organize multiple codes. This adds an extra layer of security by making the purpose of the codes indecipherable to potential unauthorized viewers. (*) Personalized access and secure viewing. Your stored data in the app is only accessible to you. When viewing your PIN, the app will display different numbers, with only you knowing the correct code position. If you happen to misplace the code location, the 'Show Code' feature comes in handy. However, remember to use this feature in private for optimal security.

With these guidelines, you can feel confident about the security of your PINs with the 7ID app.

Reasons for changing your PIN

Changing your debit card PIN is critical to fraud prevention. Here are some scenarios where a change may be necessary: (*) PIN breach: Change your PIN immediately if you think it's been compromised, either by loss, theft, or unauthorized disclosure. (*) Routine change: Many banks suggest changing your PIN every three to six months for security, although there's no hard and fast rule. (*) Easily Guessable PIN: If your current PIN is too apparent, change it to something more secure. (*) Forgotten PIN: If you can't remember your PIN, retrieve or reset it through your bank's website, mobile app, customer service, or by visiting a branch.

Does your PIN change when you get a new card?

If you get a replacement debit card, your PIN will be the same as your old one unless you requested a new one when you reported your old card lost or stolen. However, if you want to change your debit card PIN, most banks offer several ways to do so, although the procedures vary.

How to change credit card PIN?

To change your credit card PIN, consider the following options: (*) Call your card issuer's customer service using the number on your card. (*) Check your bank's website or mobile app for a “change PIN” option. If not, consider visiting your bank or speaking with a live agent. (*) Use your issuer's ATM to change your PIN by following the on-screen instructions. (*) Call your bank's customer service center. (*) Use the bank's website to change your PIN. Log in, select the Credit Card tab, and then select Change PIN. Verify the OTP sent to your mobile phone, select a new 4-digit PIN, confirm, and submit for PIN reset.

Changing your credit card PIN is an important step in protecting your account from fraud. Use the 7ID PIN Safeguard App to strengthen the protection of all of your essential PIN codes.

Extra tips for safeguarding your PIN

Here are some effective strategies for protecting your PIN: (*) Choose wisely: Choose a PIN that isn't obvious or easy to decipher, such as your date of birth, phone number, or primary sequences like 1234. (*) Be unpredictable: Your PIN should ideally be a random combination of numbers, making it harder for fraudsters to guess. (*) Use biometrics: Use biometrics such as fingerprint or facial recognition for added security. (*) Memory over paper: Avoid writing your PIN anywhere, especially on the card or your wallet. This reduces the risk of theft. (*) Regular Updates: Change your PIN periodically to reduce the likelihood of unauthorized access further. (*) Maintain confidentiality: Never share your PIN with anyone, including close friends and bank employees. (*) Discreet Entry: Use discretion when entering your PIN at public ATMs or payment docks to avoid skimming or shoulder-surfing.

With 7ID App, you no longer have to deal with the frustration caused by forgotten or misplaced PINs. With this knowledge, you can enjoy a smooth, secure, and hassle-free banking experience.

Read more:

How to Store Loyalty Cards on Your Phone?

Read the article

The Ultimate Guide to Sky Device PIN: Security, Setup, and More

Read the article